MAM/PAMM Account Brokers

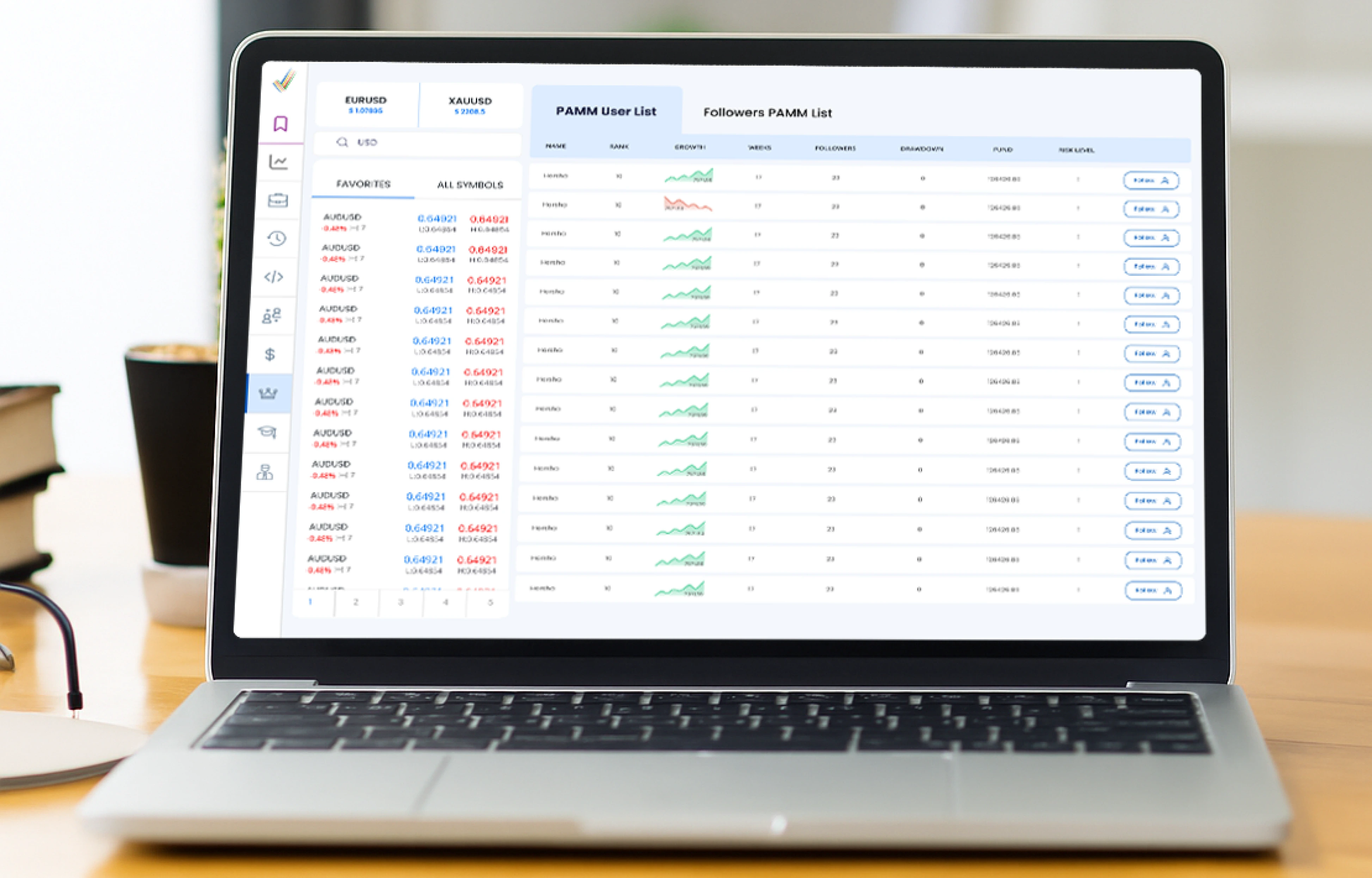

A PAMM (Percentage Allocation Management Module) account allows investors to allocate their funds to a professional trader who manages the money on their behalf. It’s ideal for clients who want to earn from trading without actively participating in the market. The trader handles all decision-making while profits and losses are distributed proportionally.

PAMM accounts are widely used by beginners or those who prefer passive income. This model ensures both trust and convenience in a highly competitive market.

How PAMM Accounts Work?

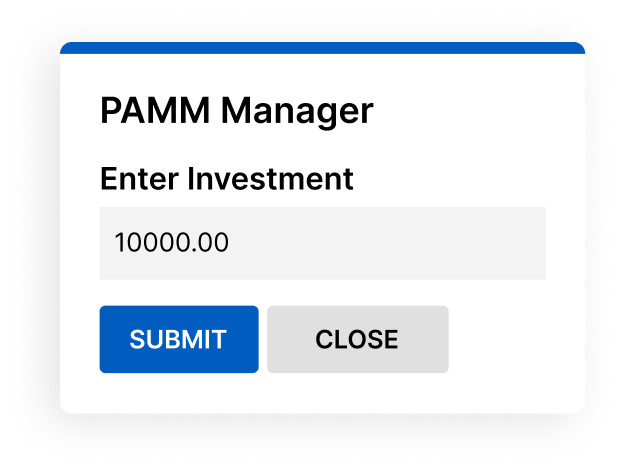

PAMM accounts combine multiple investors’ funds into one trading account operated by a manager. Each investor's share in the account is calculated based on their investment amount. When the manager executes a trade, the outcome is automatically divided among all investors according to their share, ensuring full transparency and efficiency.

All performance data is tracked in real-time, giving investors full visibility. This creates an ecosystem where trust and automation work hand in hand.

Why Brokers Offer PAMM Accounts?

Brokers provide PAMM accounts to attract investors who seek passive trading opportunities. Since traders are rewarded based on performance, this model helps brokers build trust, increase platform engagement, and boost trading volume-all while keeping operational management simple. It’s a win-win for both the brokerage and its clients. With lower operational complexity, brokers can scale their services quickly and cost-effectively.

Benefits of Using PAMM Accounts?

PAMM accounts offer a fully automated experience for investors with minimal involvement. They benefit from professional trading strategies, real-time reporting, and the ability to diversify their investments without needing trading knowledge. For brokers, it’s a scalable, client-friendly service that enhances brand credibility. Clients stay in control of their funds while enjoying expert management. This balance of control and automation drives long-term satisfaction.

What Is a MAM Account?

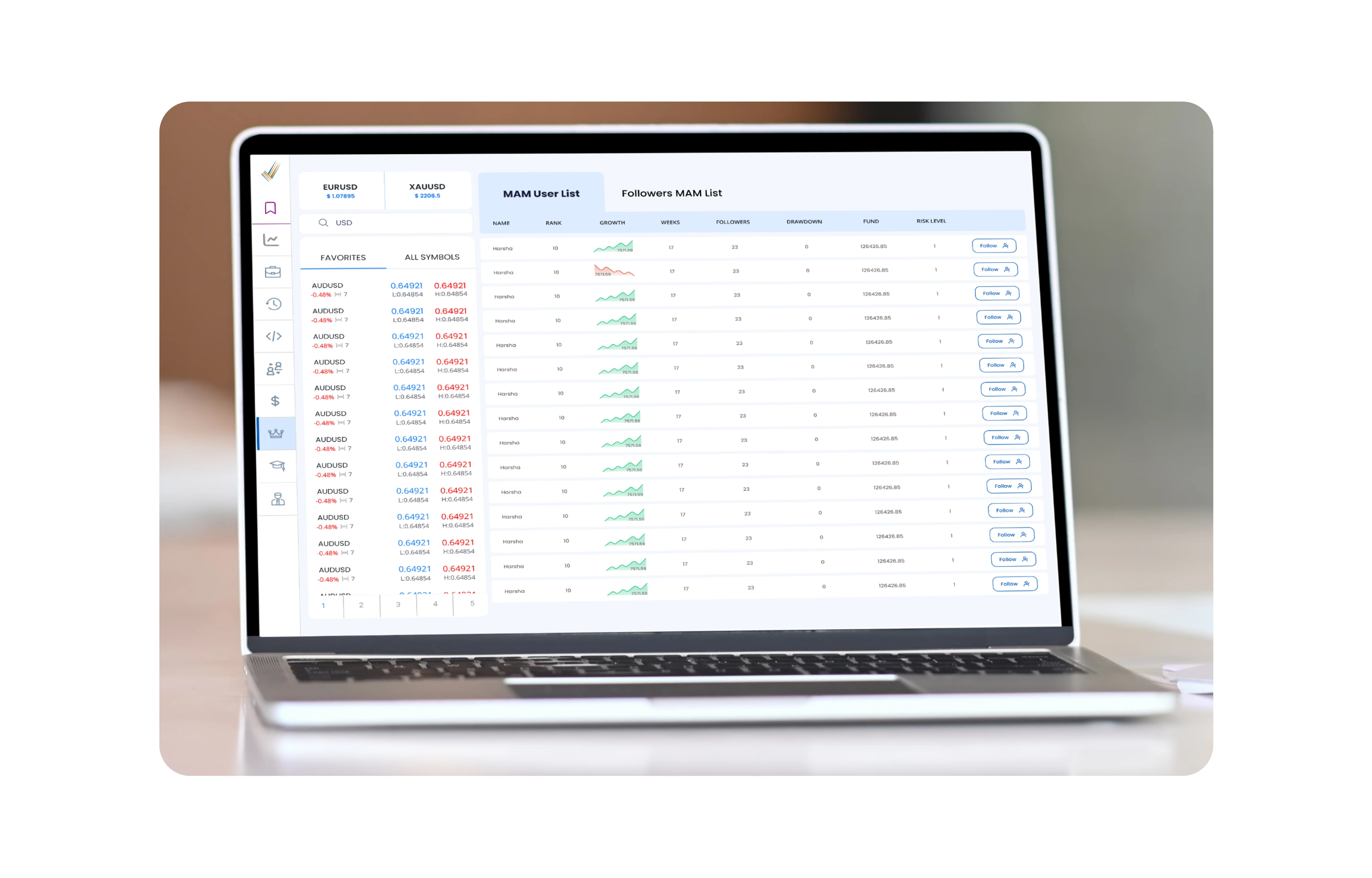

A MAM (Multi-Account Manager) account allows professional traders to manage multiple client accounts from a single interface. It’s built for traders handling varied clients with different capital and risk preferences.

MAM accounts are perfect for asset managers, family offices, and trading firms. It offers precision and scalability in a single solution.

How MAM Accounts Work

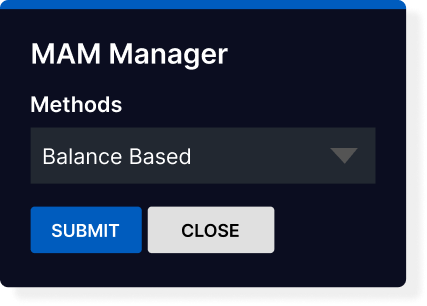

A MAM (Multi-Account Manager) account allows professional traders to manage multiple client accounts from a single interface. It’s built for traders handling varied clients with different capital and risk preferences. MAM accounts are perfect for asset managers, family offices, and trading firms. It offers precision and scalability in a single solution.

Why Use MAM Accounts

MAM accounts are ideal for fund managers or asset managers who need full control and flexibility while trading on behalf of clients. It supports advanced trading strategies and high-speed execution. With built-in risk segmentation, clients remain protected even under volatile conditions. Managers can maintain performance without compromising on safety.

MAM Accounts for Brokers

For brokerages, offering MAM accounts expands service capabilities for professional traders and institutional clients. It ensures faster execution, full transparency, and better client retention.

This solution streamlines trade management across multiple accounts with minimal latency. It also enhances trust by offering real-time reporting and improved control over allocations.

MAM systems also help brokers support diverse account types with minimal effort. This versatility enhances your competitive edge in a growing market.

It allows seamless integration of various trading strategies across different client profiles. Efficient resource management and scalability make it ideal for long-term growth.

Xtremenext Wealth Routing: PAMM vs MAM Unlocked

Allocation

Trades are distributed by percentage based on each investor’s capital in the pool. All accounts follow the same proportional performance.

Flexibility

Limited control over trade size or risk per client. All investors follow the same strategy equally.

Transparency

Investors see only their share of profits/losses. Trade-level visibility is minimal.

Compliance

Simpler compliance process, especially in less-regulated environments due to pooled account structure.

VS

Allocation

Trades are allocated by volume (lot size), allowing managers to customize position size, risk level, exposure, leverage, margin, and capital allocation per client.

Flexibility

Offers full flexibility to adjust risk, exposure, and lot size for each investor individually.

Transparency

Investors can view all trades in real time in their own accounts, enhancing trust and control.

Compliance

More suitable for regulated setups where client-level control and reporting are required.