What is Forex Liquidity?

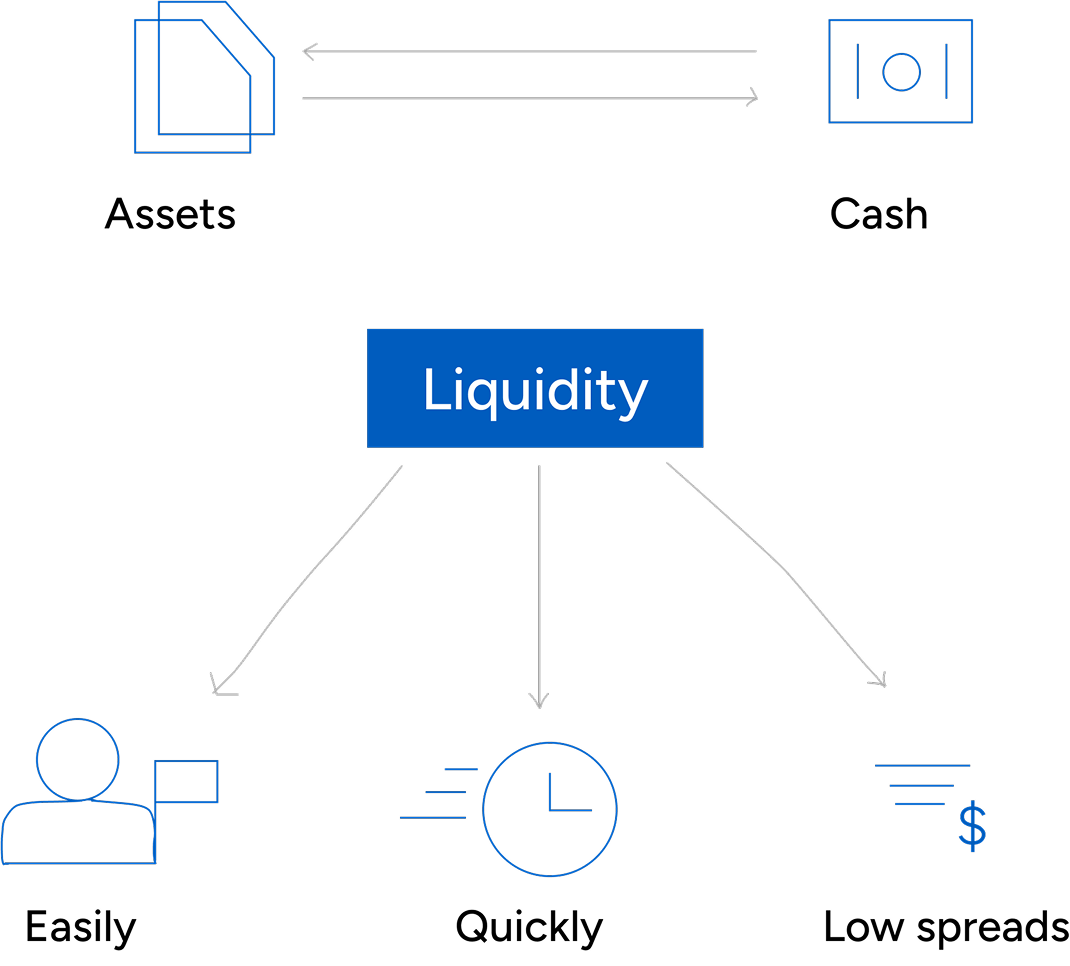

Forex liquidity refers to the ease with which a currency pair can be bought or sold without causing a significant shift in its price. The more liquid a market is, the smoother the transaction process becomes. High liquidity reduces the risk of price fluctuations during trades, ensuring traders can enter or exit positions swiftly. This stability is crucial for both retail and institutional traders. Liquidity is often defined by the volume of active participants and the size of the orders they can handle. It directly influences trading costs, execution speed, and overall market efficiency.

The Importance of Liquidity in Trading

Liquidity plays a pivotal role in the foreign exchange market, acting as a foundation for smooth, efficient trading. It ensures that traders can execute orders quickly and at competitive prices without substantial slippage. This is especially important for high-frequency trading and scalping strategies, where speed is essential. In markets with high liquidity, price discovery is more transparent, and order fulfillment becomes more predictable. It also contributes to market depth, where larger orders can be processed without causing significant price distortions. Liquidity essentially enhances the overall market experience by maintaining balance and stability.

Benefits of High Liquidity in Forex Markets

High liquidity in forex markets leads to narrower bid-ask spreads, allowing traders to reduce transaction costs. A more liquid market means quicker execution of trades, especially in volatile market conditions. Traders can also benefit from better price transparency, which helps in decision-making. With liquidity, market depth is increased, reducing the chances of a price shock caused by large trades. Additionally, high liquidity supports a more efficient price discovery process, as orders are matched quickly and fairly. All these factors combined contribute to a healthier and more profitable trading environment.

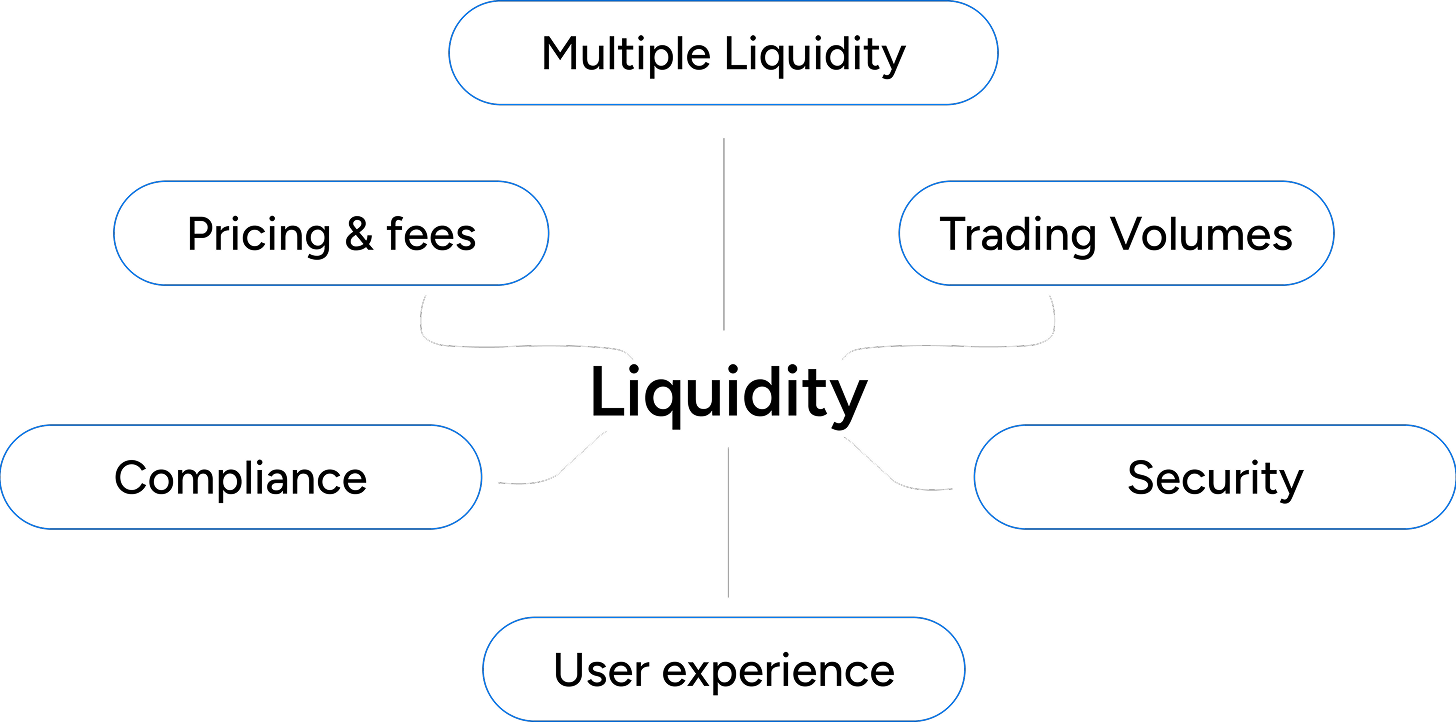

Multiple Liquidity Providers: A Strategic Advantage

Using multiple liquidity providers ensures access to a broader range of prices and market depth. By aggregating liquidity from different sources, brokers can offer tighter spreads and enhanced execution speeds. This approach provides traders with more reliable access to liquidity, even during periods of high volatility. With multiple providers, brokers can diversify risk and reduce reliance on any single source, thus ensuring smoother trade execution. It also improves market stability as liquidity is drawn from various pools, reducing the impact of potential liquidity shortages. Brokers and traders benefit from better pricing and lower trading costs.

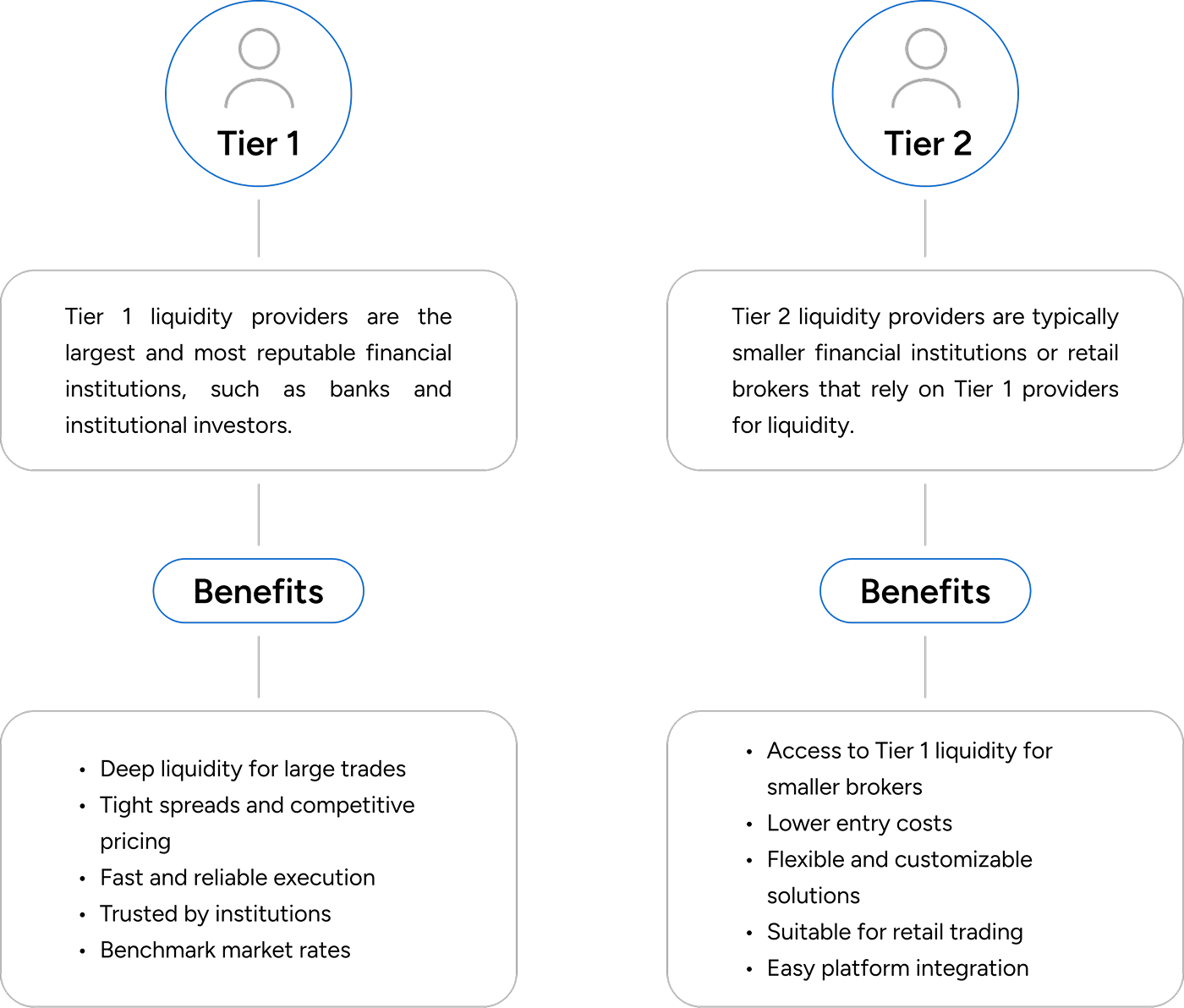

Types of Forex Liquidity Providers

There are several types of forex liquidity providers, including banks, market makers, hedge funds, and ECNs. Banks are the largest liquidity providers, offering substantial volumes and competitive pricing. Market makers add liquidity by quoting both buy and sell prices, ensuring trades can be executed even in volatile conditions. ECNs, on the other hand, aggregate liquidity from various participants, offering transparent pricing and direct order matching. Hedge funds also provide liquidity by holding significant positions in various assets, facilitating trades during high-demand periods. Each provider type plays a unique role in ensuring the efficient functioning of the forex market.

How Liquidity Affects Spreads and Transaction Costs

The level of liquidity directly influences the bid-ask spreads in the market, which in turn affects transaction costs for traders. In highly liquid markets, the spreads tend to be narrower, meaning traders can enter and exit positions at more favorable prices. Lower spreads result in lower overall trading costs, making it easier to achieve profitability, especially for scalpers. Conversely, low liquidity leads to wider spreads, increasing transaction costs and making it harder to execute orders at desired prices. The relationship between liquidity and spreads is vital for traders to understand, as it affects the cost-efficiency of their strategies.

Risks of Low Liquidity in the Market

Low liquidity in the forex market can lead to higher volatility, making price movements more erratic and difficult to predict. This can cause traders to experience slippage, where their orders are executed at a different price than expected, increasing costs and reducing profits. In extreme cases, low liquidity can lead to the inability to execute trades at all, as there may not be a counterparty available to match the order. Wider bid-ask spreads are another consequence of low liquidity, which raises transaction costs. The lack of liquidity can also disrupt price discovery, making it harder to assess the true value of assets in the market.

Why Choose a Multi-Liquidity Solution?

A multi-liquidity solution aggregates liquidity from various providers to offer the best available pricing and trade execution speeds. It helps brokers mitigate risks by reducing their reliance on a single liquidity source, ensuring that they can access deep liquidity pools at all times. With multiple providers, brokers can select the most competitive pricing, which in turn benefits traders through tighter spreads. Multi-liquidity solutions also enhance price stability, even in times of high volatility, by ensuring continuous market activity. By using this approach, brokers and traders can enjoy enhanced execution times, lower transaction costs, and better overall market conditions.

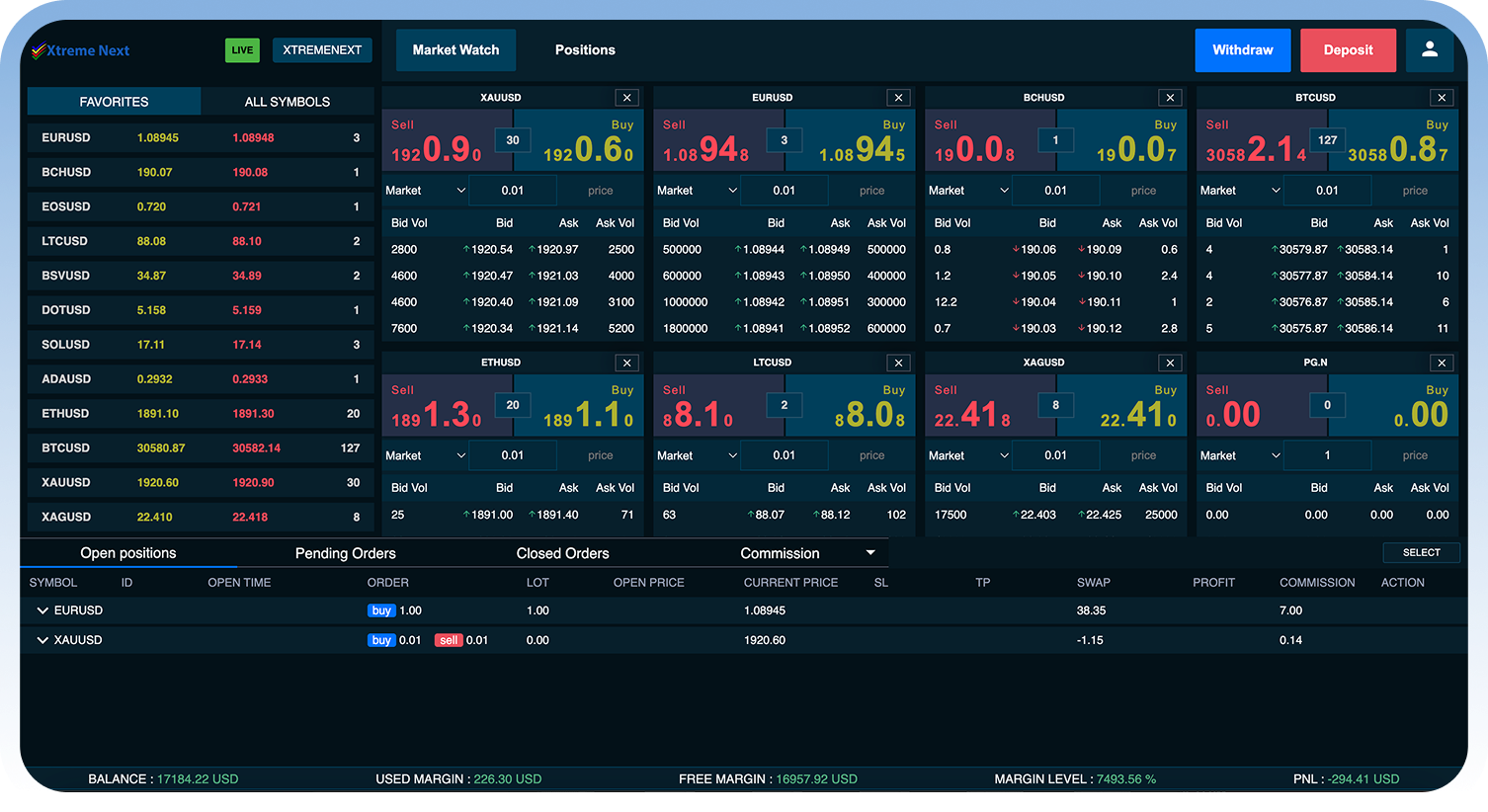

XtremeNext Has Multiple Liquidity Providers

XtremeNext leverages multiple liquidity providers to ensure optimal market conditions for its traders. By aggregating liquidity from various sources, XtremeNext offers tighter spreads, faster execution times, and deeper market access. This approach reduces reliance on any single provider, helping to mitigate risks and ensuring that orders are fulfilled efficiently, even during high volatility. The use of multiple liquidity providers enhances pricing transparency and stability, enabling traders to make informed decisions with greater confidence. Additionally, this strategy allows XtremeNext to cater to a wide range of trading preferences and asset classes, providing a comprehensive and competitive trading environment.