High-Performance Connectivity for Modern Markets

At XtremeNext, we recognize that the future of trading lies in fast, direct, and scalable access to the financial markets. Our institutional-grade FIX API offers exactly that. Designed for hedge funds, brokers, fintech developers, and quantitative traders, our FIX API provides direct, server-to-server connectivity that eliminates reliance on third-party platforms. This connection streamlines access to live market data, ultra-fast execution, and seamless communication with global exchanges and liquidity providers—all with precision and near-zero latency.

What is FIX API and Why It Matters

The Financial Information eXchange (FIX) API is a globally accepted electronic protocol that facilitates the real-time transfer of trading information. It’s more than a software integration—it’s a continuous communication channel between your system and the market infrastructure. Unlike REST APIs that operate on one-time pull requests, FIX APIs maintain a bidirectional, live session that streams data as it happens. This ensures that you’re always in sync with every tick, update, and price movement—giving you a massive edge in execution speed, accuracy, and responsiveness.

Multi-Market Support Beyond Forex

Although widely known for its use in the forex industry, the XtremeNext FIX API is engineered for multi-asset functionality. Our FIX protocol supports a broad range of financial instruments including stocks, commodities, precious metals, energy assets, bonds, and cryptocurrencies. This makes it a perfect solution for diverse trading strategies across asset classes. Whether you're a liquidity aggregator, proprietary desk, hedge fund, or broker dealer—FIX gives you the flexibility to operate at scale, across multiple markets, under a unified framework.

Lightning-Fast Execution and Low Latency

Speed is everything in trading, and the FIX API is purpose-built for low-latency environments. The lightweight structure of FIX messages allows us to maintain communication speeds as low as 1 millisecond. This is essential for high-frequency and algorithmic traders who depend on real-time decision-making and rapid order placement. With XtremeNext, your orders are processed with minimal delay and maximum reliability—even during high-volume sessions or volatile market conditions. Our infrastructure is also highly scalable, so you can run multiple sessions and handle vast data throughput without congestion or bottlenecks.

Secure, Anonymous, and Developer-Friendly

Security is at the core of everything we build. Our FIX API enables direct communication with the market, bypassing intermediaries and protecting your data. The server-to-server protocol ensures encrypted transmission, full anonymity, and complete control over your trading environment. For developers and tech teams, integration is seamless. Our FIX infrastructure is compatible with standard FIX 4.2 and FIX 4.4 versions and works smoothly with Java, C++, Python, and other major programming languages—making it easy to customize and deploy within your proprietary systems.

Real-Time Data for Every Trading Phase

The XtremeNext FIX API delivers comprehensive data coverage across every stage of the trade lifecycle:

-

Pre-Trade Data: Includes order book depth, market liquidity levels, bid/ask volume, and trading volume insights—vital for formulating strategies and identifying optimal entry points.

-

Trade Data: Encompasses real-time execution updates, fill confirmations, slippage rates, and live pricing during the trade—ensuring transparent operations.

-

Post-Trade Data: Offers settlement confirmations, trade reconciliation, position updates, and P&L reporting—helping traders maintain accurate records and financial clarity.

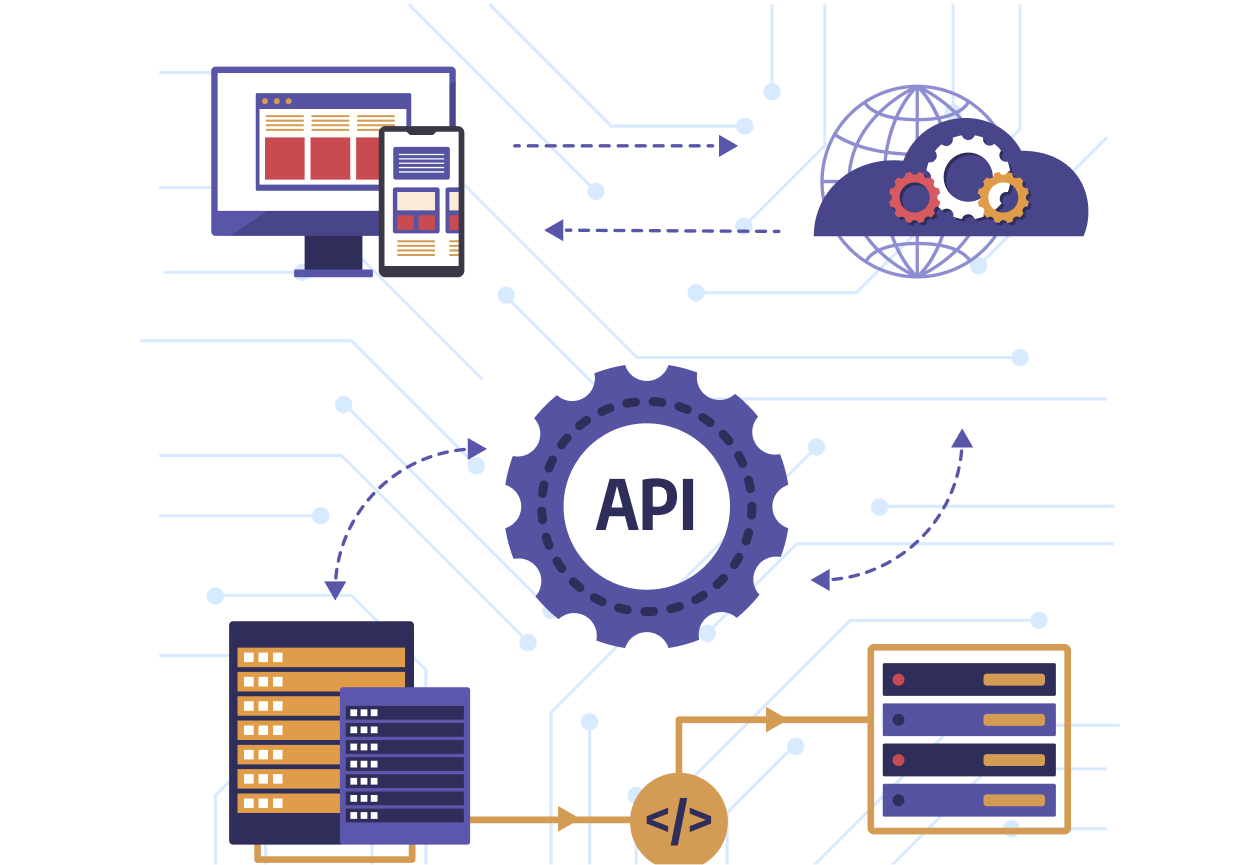

FIX API vs REST API: What’s the Difference?

While REST APIs are versatile for general application development, they’re not optimized for trading speed. REST uses a request-response model that must query data repeatedly. In contrast, FIX APIs push live data to you in real-time, maintaining an open stream of information. FIX is a purpose-built standard for institutional trading, originally developed to replace the inefficiencies of phone-based trading and now used globally by financial institutions, hedge funds, and electronic trading systems.

Considerations and Best Use Cases

FIX APIs are ideal for real-time trading and high-volume operations, but they come with specific characteristics. They’re not built for retrieving historical data or querying static account metrics like equity or leverage. These capabilities may require supplemental API endpoints or custom reporting modules. However, for traders and institutions seeking fast, direct, and secure access to live markets, FIX remains the gold standard for performance and reliability.

Trade with XtremeNext FIX API

Whether you’re building a custom trading engine, launching a quant fund, or scaling a brokerage operation, XtremeNext FIX API gives you the tools to operate with unmatched efficiency and control. Experience low-latency trading, access multi-asset markets, and gain full visibility into your trading lifecycle with one of the most trusted protocols in the industry.