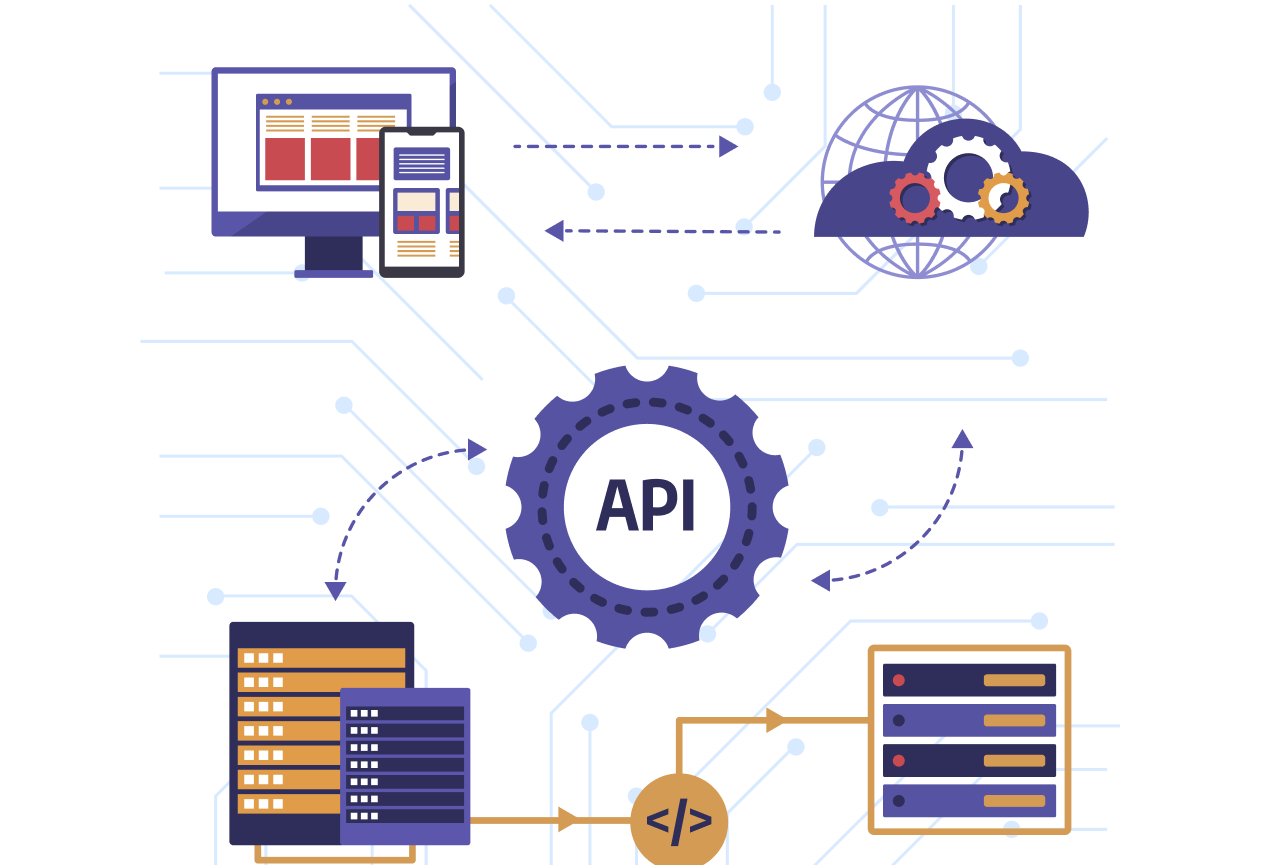

. The bridge includes a service for individual trade setup through which customers can configure the orders according to their preferences. Our bridge is fast, stable and flexible, allowing for detailed configuration of different parameters of hedging and overall performance. The bridge does not require a separate server, it can be easily run in parallel with other types of accounts and handle a limited number of groups. The bridge connects directly to ECN and can operate either as a separate provider or with any number of providers connected to the aggregator.

Built for high-volume trading, ensuring smooth performance even in large-scale operations.

Execute trades quickly and handle large data volumes with minimal delay.

Integrated trade setup features streamline operations and enhance efficiency.

The Xtremenext Fix API Bridge offers seamless connectivity and fast, stable performance for large-scale trading operations. With customizable trade setups and advanced functionality

Experience a flexible and efficient hedging system with Xtremenext that allows partial hedging for individual instruments, customer groups, or specific accounts.